- Product

- Documentation

- Blogs

- Contact us Exchange

The largest designated market makers on some crypto exchanges are able to get negative fees on maker orders - usually a few basis points. They literally get paid to trade, but they have to trade billions of dollars of volume to do so. Deepwaters thinks everyone should be able to get those incentives, so we’re rolling out an incentive structure that gives you the same benefits as the largest institutional traders! You can get an effective total rebate of between 0.02% and 0.04% when you pay your maker fees in WTR. You can get paid to trade crypto on the Deepwaters exchange!

How It Works

Place a maker limit order of at least $100 value.

Pay your 0.02% maker fee in WTR. WTR will automatically be used to pay for fees if you have WTR in your Deepwaters account.

Your Deepwaters account will automatically be credited 0.04% of the order size in USDC!

Remember, Deepwaters always treats WTR as being worth $0.70 when paying for fees, so your effective rebate may be even higher!

ELI5 Detailed Explanation

In an order book-based exchange, there are two types of orders, based on how they execute: taker orders and maker orders. Maker orders add liquidity to the order book. Taker orders are immediately executed against the order book when placed, and remove liquidity from the order book.

In order to ensure your order is a maker order, it must fulfill two requirements:

It must be a limit order (market orders are always taker orders)

It must not “cross the book”. In other words, if you are buying, your price must be low enough that it does not immediately match with an “ask” already on the order book. If you are selling, your price must be high enough that it does not immediately match with a “bid” on the order book.

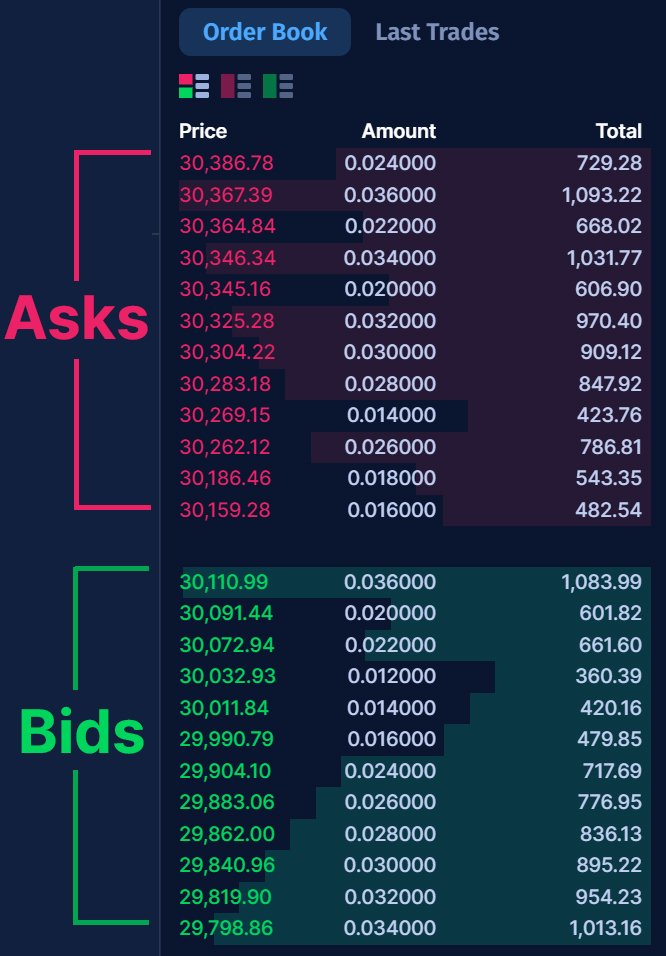

The below image shows the BTC-USDC order book. In that moment in time, a maker order would be either:

A limit order to buy BTC at a price of 30,159.27 USDC per BTC or less

A limit order to sell BTC at a price of 30,111.00 USDC per BTC or more.

Note, however, that the order book is not frozen in time like this image is! In a live market, placing an order too close to the other side of the spread - the gap between the bids and asks - could result in the market moving between the time you enter it and when it is processed on the order book (currently about 60 milliseconds, but can and does vary).

How to Place a Limit Order on Deepwaters

Go to the Deepwaters app at app.deepwaters.xyz

If you haven’t registered yet, connect your wallet by clicking the button at the top right, and complete KYC.

At the main Dashboard, either:

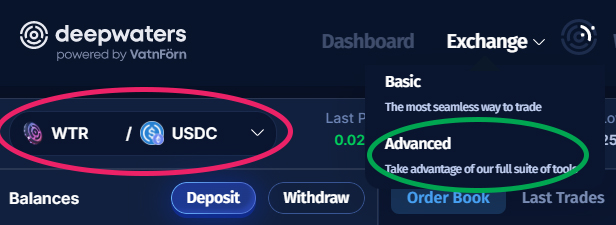

select Exchange → Advanced from the top navigation bar then select your desired pair from the pairs drop-down menu

scroll down to the pairs table, and click the “trade” button in the row for your desired token

On the advanced trading screen:

Select whether you want to buy or sell

Enter the limit price for your order. Remember not to cross the books if you want the “get paid to trade” rebate!

Enter the quantity you want to buy or sell.

If desired, set an expiration for your order.

Press the “place order” button!

You will need to use the advanced trading interface. Yon can select “Advanced” from the “Exchange” drop-down (green ellipse), then select your desired pair using the pairs drop-down (red ellipse).

The steps to placing a limit order on the Deepwaters app. The numbers correspond to the numbers in the list above. Note that the entered limit buy price is lower than the lowest ask price (selling price) on the order book.

FAQ

Is there a way to ensure my order is a maker order and does not cross the book? Right now, you just need to ensure your order is far enough from the other side of the book when you place the order. We will be developing a “post only” function which will reject a limit order which would execute as a taker. We cannot provide a timeline for that yet.

Why does my order need to be at least $100 to qualify for the maker rebate? Deepwaters currently has extremely low limits on trade size: just one dollar. We currently only receive 8 basis points, or 0.08%, in fees for taker orders. This means on a $100 order, the taker pays just $0.08 in fees. While the marginal cost of processing orders is extremely low, it is more than zero! Therefore, we need to have a minimum order size to qualify for maker rebates in order to ensure we can operate profitably.