- Product

- Documentation

- Blogs

- Contact us Exchange

What are market orders?

A market order buys or sells an asset immediately, using the [current] best available price.

Why traders almost always lose on market orders

In a perfectly ‘fair’ world, market orders would be executed strictly against a public order book.

However, exchanges have the ability to obtain first access to order flow and reserve the right to trade against their clients (internal netting). Even market makers are subject to this type of exploitation.

Alternatively, the exchange may sell information about the order flow, and/or the order flow itself, to a third party. This will have a similar effect on the price and execution. This type of trade flow manipulation, in conjunction with privileged execution rights such as wholesale internalization, privileged colocation, and privileged cancellation rights, give the exchange and its closest partners the ability to create a type of constant MEV-like effect for unprivileged and retail traders. Traditional finance has a Trade-Through Rule, which makes it more difficult to exploit the order flow with impunity. However, idiosyncrasies of timing make it only partially effective. In crypto trading, which lacks National Best Bid and Offer (NBBO), the situation is much more dire, resulting in a Wild West-like dynamic.

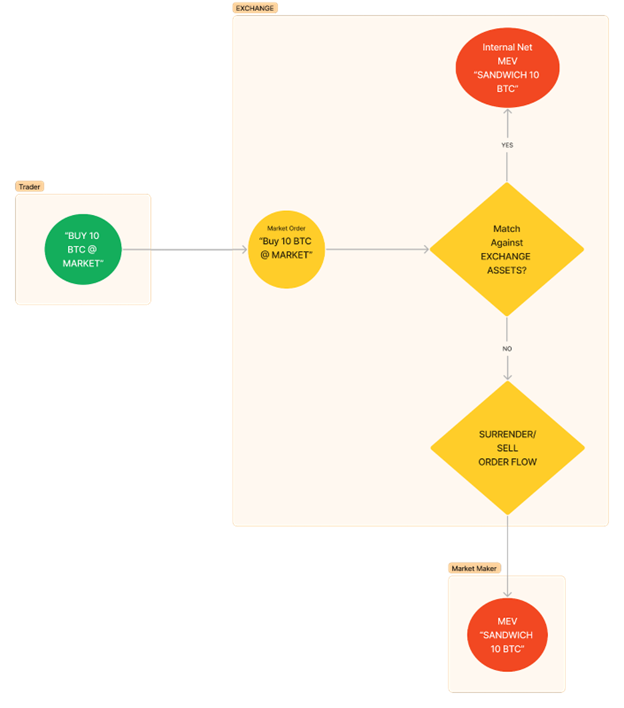

Consider the following example:

Market Order: The Status Quo

From the traders perspective, there are two immediate effects of this kind of order flow manipulation: The first is price deterioration. Second is adverse selection, where the trade starts losing money the moment it is filled. This is similar to the MEV effect in Decentralized Exchanges.

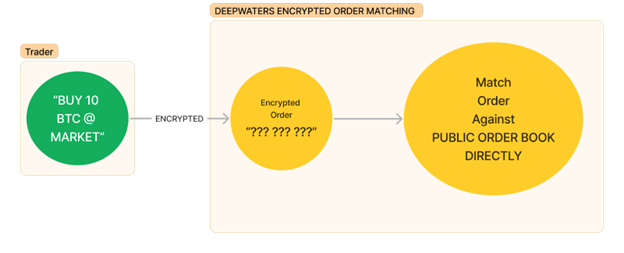

Deepwaters Protected Market Orders

Deepwaters solves the problem of market orders by executing trades off-chain utilizing confidential computing: no one, including ourselves, can see or interact with the trade flow. This black box prevents Deepwaters from creating privileged counterparties, which eliminates the potential for price fade and adverse selection altogether. If a billion dollar market order were to be placed on Deepwaters, only the trader would have any knowledge of this until the order was executed against the public order book, using the original order sequence and at the price determined by the depth of available liquidity.

Best of all, you don’t need to take our word for it. We’re building a unique set of tools to allow anyone, without requiring any special knowledge or privileges, to audit our system. Anyone can verify that the execution of trades inside this black box is, in-fact, managed by our public trading rules, and all trades are truly treated equally.

Public Order Book = (Ask 5 @ 16000, Ask 5 @ 16010… etc)

Market Order “Buy 10 @ Market” => Buy 5 @ 16000 + Buy 5 @ 16010

M“No Games - No Slippage - Just Natural Selection”

For reference: https://www.figma.com/file/7Pg2PrNgelDRVW2f7wQ27g/Market-Makers-and-Low-Toxic-Flow-Resources?node-id=0%3A1&t=t9ZM7rsUKpNG4lBD-0