- Product

- Documentation

- Blogs

- Contact us Exchange

#DeFi

21 Jul 2022

Toxic Order Flow

Toxic Order Flow is commonly defined as a trader’s exposure to the risk of counterparties taking advantage of private or privileged information to create disadvantages for traders and market makers.

23 Mar 2022

Variable, Fixed and Stable Interest Rates in DeFi

DeFi lending protocols offer a number of options for how interest rates are determined. Rates may be variable, stable, or fixed. We explore what each of these terms means and how it affects loans.

![Header image for Interest Rates Learn article.]()

08 Mar 2022

What are Gas Fees?

Gas fees compensate miners for the computational costs of the blockchain. Gas fees can adversely affect DeFi users, but understanding them allow users to transact more efficiently and effectively.

![]()

30 Jun 2022

Centralized Lending

Reliable, secure, on-chain self-custody of funds will help drive market maturity in the digital asset space.

![Lending]()

29 Mar 2022

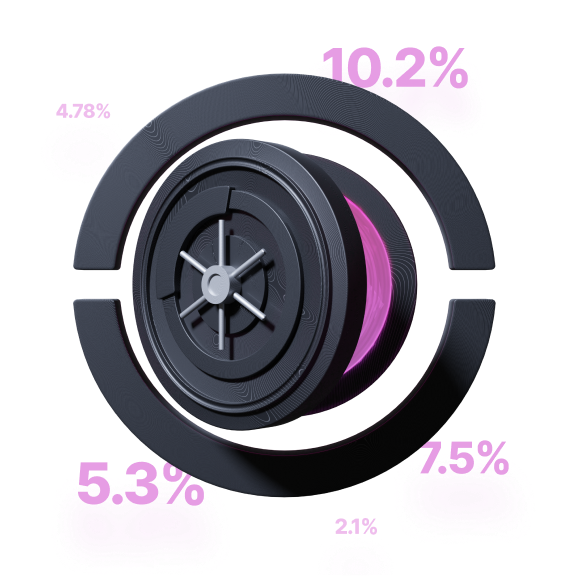

What is Slippage in DeFi & How Does Slippage Occur?

Due to the nature of decentralized exchanges, many are particularly prone to slippage, which causes trades to execute at worse prices. We explain this phenomenon and why it occurs.

![]()

01 Mar 2022

What is Partial Liquidation?

Historically liquidations in DeFi have been all-or-nothing. Partial liquidations protect borrowers and provide a kinder alternative to simple binary liquidations.

![]()

19 Feb 2022

How Do Loans Work in DeFi?

The promise of decentralized finance is that the system exists to the benefit of the participants. The shift from centralized to decentralized financial platforms has been limited by many factors...

![]()