- Product

- Documentation

- Blogs

- Contact us Exchange

Time is money in DeFi, and today we ponder how time impacts the interest you might pay across variable, fixed or stable-rate loans. Borrowers should keep an eye on the likelihood of interest rate risk, as an increase in their base rate may lead to more accrued interest and thus, a greater likelihood of liquidation.

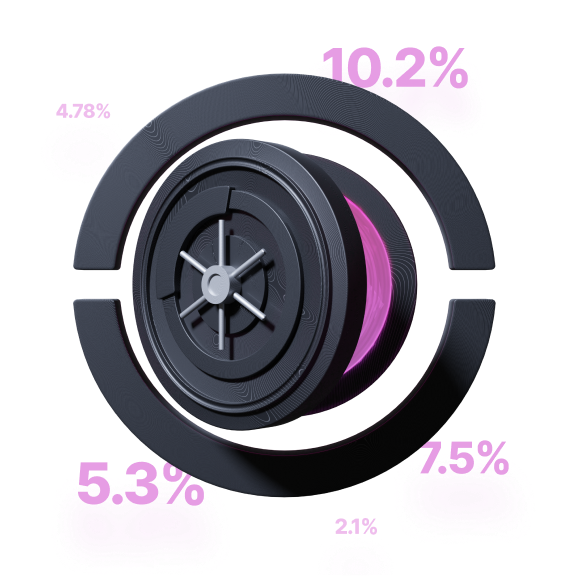

Interest rates in DeFi are determined across each Ethereum block, meaning that variable interest rates are susceptible to change from one block to the next. With information processed gradually across each block, the price of an asset, along with the volume traded, can suddenly change the base rate. Borrow APY (annual percentage yield) refers to the interest rate borrowers pay to lenders, plus accrued interest and the time taken to repay.

Compound and Aave, for instance, are two separate protocols with different lending options. Whereas Compound offers exclusively variable-rates, Aave provides both variable and stable-rate loans. The base interest for stable-rate loans will be inherently higher, in exchange for the added security and predictability.

E.g. David has the option of a DeFi loan with a variable interest rate and a stable-rate through Aave. The variable interest rate is 6% and the stable interest rate is 7.79%.

David decides to borrow 1 ETH with an initial 6% variable interest rate but due to volatility, the price and volume of ETH being traded drives the borrow APY up to 8%.

He will now have to pay more accrued interest along with the value of the initial loan to receive his collateral.

In the example, the stable-rate provided by Aave could have prevented the increase in borrow APY, as it is designed to mitigate the impacts of market volatility on a loan. However, stable-rates are subject to change in the case of a drastic crash, whereas fixed-rates are not.

Fixed interest rates come at a premium, much like stable-rates, but ensure that the borrower will never be put at risk of a high borrow APY, so long as they repay consistently. While stable rates may change if there is a change to the health of the loan, the interest rate on fixed rate loans will never change.