- Product

- Documentation

- Blogs

- Contact us Exchange

TL;DR

The incredible economic inefficiency of the BAYC Otherside digital land sale describes the ongoing journey to maturity for Ethereum and the DeFi ecosystem broadly. Yuga Labs raised ~$300 million selling NFTs for the anticipated Otherside metaverse (which owners do not have commercial rights to) in the largest NFT sale to date. An additional ~$180 million was spent on gas fees throughout the mint, with some users spending tens of thousands of dollars to acquire an NFT, and others spending significant amounts on failed transactions. Yuga Labs tweeted after the event that they might need to move to their own chain in the future, although many other options exist and there isn’t much evidence that Yuga Labs have begun seriously considering them; such as: contract optimization, taking some processes off-chain, leveraging L2 scaling solutions, or waiting for the merge.

Network Congestion

Gas fees on Ethereum ensure that the network is resistant to denial of service attacks. Bitcoin miners aren’t at risk of wasting time trying to process transactions including infinite-loops because the format of transactions is deliberately constrained. Ethereum on the other hand is Turing complete, meaning that arbitrarily complex code can be run on the Ethereum network. This motivates the need to prevent miners working away forever on unsolvable problems (such as those posed by bugs in code resulting in infinite loops, or malicious actors seeking to launch denial of service attacks. Hence, Ethereum has gas which users pay proportional to their resource use on the network.

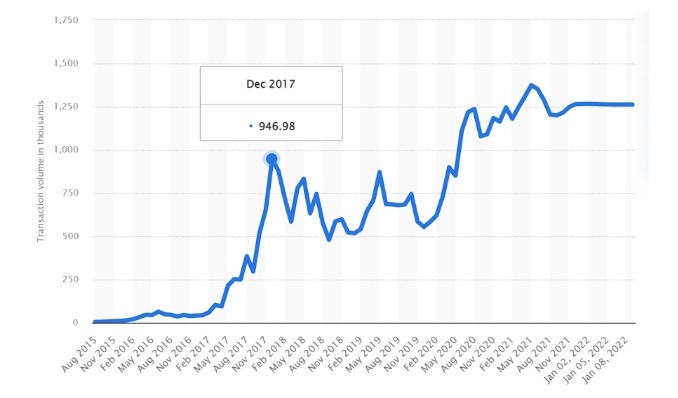

Ethereum’s gas fees have been a variable point of contention since the early days of the network. When CryptoKitties, the first major NFT project on Ethereum, launched in 2017 Ethereum saw more transactions per unit time than ever before in its history (fig1). In addition to taking up a significant proportion of the transactions on Ethereum, there was also a major increase (~6X) in the number of pending (incomplete) transactions. Miners had been increasing the block gas limit earlier in 2017 and did so again in response to the CryptoKitties demand.

fig 1: ETH network TXs over time, CryptoKitties launched Nov 28th 2017

Ethereum’s maximum block size increased most recently with the London Upgrade. This did not prevent outrageous gas fees and failed transactions at recent points of high network congestion. The BAYC Otherside NFT mint in April of 2022 raised $285 million, while costing users over $176 million in gas fees as gas prices shot up (fig2) faster than ever before. For every dollar raised, $0.60 was sent to miners and either taken as an incentive to prioritize transactions, or burned via EIP-1559. Some developers have made reasonable cases that as much as 40,000 ETH could have been saved on gas fees, had relatively straightforward optimizations been made to the project's smart contracts.

fig 2: ETH gas price, can you spot the Otherdeeds mint? source

In the heyday of ICOs, it wasn’t uncommon to whitelist addresses for early access to offerings. While Yuga Labs performed KYC for the user addresses allowed to participate in the sale, there was no attempt to order the transactions. Earlier plans to perform a dutch auction were scuppered, with Yuga Labs instead opting for a fixed APE coin denominated price per NFT. Each Otherdeed NFT was on sale for 305 ApeCoin (~$5,800 at the time of the sale), so participants weren’t bidding for the NFTs at variable prices, they were bidding for block space before the mint was finished and all tokens were sold. This makes the almost $200 million spent on gas seem even more unnecessary.

One industry observer suggested that $80 million less could have been spent on gas fees had just three simple changes been made to Yuga Labs’ smart contracts. Particularly, verifying the ownership of NFTs off-chain, rather than on-chain (via ERC721Enumerable), could potentially have saved as much as $70 million. Further, leveraging ERC721a might have saved $10 million by lowering the cost of minting multiple tokens to the same wallet. There is also an argument that the _safeMint() portion of the ERC-721 standard did not need to be utilized here, since it functions to confirm those addresses minting NFTs can actually receive ERC-721 tokens. With address KYC occurring ahead of the sale, this didn’t need to be performed on-chain during the mint.

Yuga Labs tweeted after the sale indicating an intention, or interest, to develop their own blockchain as a means to avoiding similar disasters in the future. To the frustration of industry actors who see ‘gas wars’ as a solved problem. If none of the above solutions were viable or satisfactory, Etheruem has Layer 2 solutions facilitating low-gas NFT transactions. It remains to be seen if Yuga Labs will create a blockchain with similar security as Ethereum L2 solutions. Keeping NFTs on Ethereum has major benefits in virtue of standardization, not least because we avoid multiple representations of ownership on multiple chains.