- Product

- Documentation

- Blogs

- Contact us Exchange

TL;DR

Bitcoin, ETH and the longtail of alt-coins all took major losses the week of May 9th, while prominent stablecoins lost their peg. First UST, previously an $18 billion stablecoin, lost its peg dramatically, trading as low as $0.30, as its supporting ‘growth’ token Luna lost almost all of its value. Cryptoassets have been highly correlated with NASDAQ and Tech Stocks, an ongoing investors sell off for perceived risky assets is impacting both markets. Part of the downwards price pressure on BTC has been in virtue of reserves being sold to prop up UST’s value, essentially buying UST and burning it to increase the price per unit of UST remaining. On Thursday May 11th, Tether (USDT) a broadly adopted stablecoin with a market cap of ~$82 billion started to deviate from its peg, dipping as low as $0.95 and trading at $0.995 as of writing. On May 12th, the Terra blockchain halted.

Terra

Terra is a Proof of Stake (PoS) blockchain where LUNA tokens are staked in order to generate new blocks. Terra’s UST is an experimental algorithmic stablecoin on the basis of elastic supply. While demand will vary at the whims of the market, supply is more easily influenced by Terra. If the price of UST falls below $1 then UST are bought and burned, thereby removed from the supply and (all other things being equal) provides an upwards price pressure on UST. Conversely, if the price of UST exceeds $1 then more UST are put into circulation and (again, all other things being equal) provides a downwards price pressure on UST.

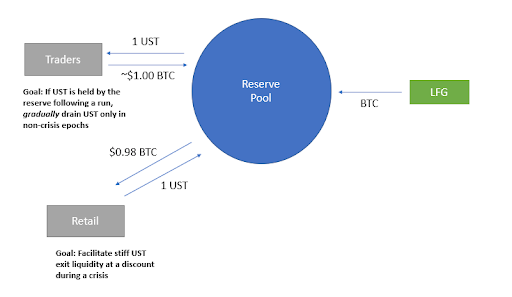

The Terra protocol is designed to include an available counterparty for anyone wishing to swap Terra for Luna, and vice versa, at the targeting rate. Terra’s default wallet, Terra Station, is designed to include functionality such that a user can always swap 1 UST for $1 (USD) worth of LUNA. The obvious risk here is that LUNA loses value on the market and there isn’t a liquid market for supporting UST’s price. Going into the LUNA crash, the Luna Foundation Guard (LFG) had accrued ~$1.6 billion in BTC in their reserves. On May 8th Do Kwon announced $750 million of BTC would be made available to buy UST and prop up the price of UST.

Terra has a governance proposal for making BTC to UST trading algorithmic, on-chain via smart contracts, similarly to LUNA to UST. The BTC held in reserve would be made immediately available via such a mechanism, however this system was not live ahead of the crash.

fig1. source

LUNA, the price variable token supposedly designed to help the UST token hold a value equal to that of USD, lost practically all of it’s value (from ~$86 on May 4th to $1.07 on May 11th); UST started to significantly deviate from it’s peg at the same time and (as of May 11th trading between $0.3 and $0.8 over the course of the day) still hasn’t returned to it’s nominal $1 peg.

Some industry observers have compared the run on LUNA and UST to Black Wednesday, where George Soros took a profit of over 1 billion GBP by shorting the British national currency. He was able to do this since European countries were setting targeted exchange rates via the European Exchange Rate Mechanism (ERM), pegging the currencies to one another at specific rates. States participating in the ERM were expected to keep their currency within certain exchange rates; reserves of cash were held onto to help protect exchange rates should it be necessary. Traders shorted the pound by purchasing foreign currency with GBP such that a profit was available in the event that GBP decreased in value relative to the foreign asset. The U.K. government has If the reader is intrigued, see “the vulnerability of pegged exchange rates”. On the face of it, the BTC reserves that stood to try and protect UST’s peg to the USD look rather similar to this setup.

While it’s very possible that a large BTC short position was taken ahead of the crash, with the knowledge that UST’s peg would soon be in trouble and large quantities of BTC would be sold in order to try and protect the peg, there were other things at play that would have been sufficient in and of themselves to disrupt markets.

Anchor

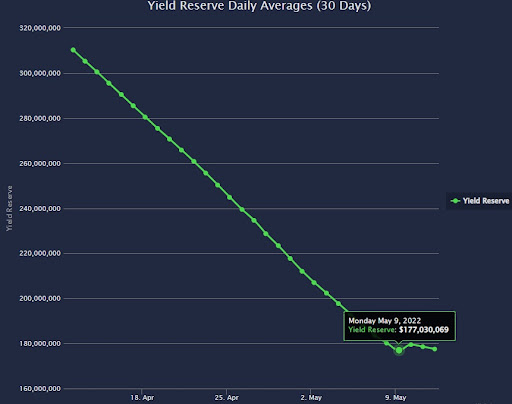

Anchor protocol offered users ~20% APY on their staked UST. On Friday May 6th Anchor had approximately ~14 billion UST deposited on their dApp, which had been steadily growing since May of 2021. Anchor’s yield reserve on May 6th was approximately $188 million and had been dropping considerably for the previous 30 days (fig2). While users can, supposedly, withdraw their deposited tokens at any time, how they realize their yield is another matter. A 20% yield on ~14 billion UST is 2.8 billion UST. It would appear a system like Anchor only works if everyone keeps their tokens and ‘yield’ deposited and unrealized respectively. As soon as people start making a dash for the exit with their less than hard earned cash, funds start to run out for the remainder.

fig2. source

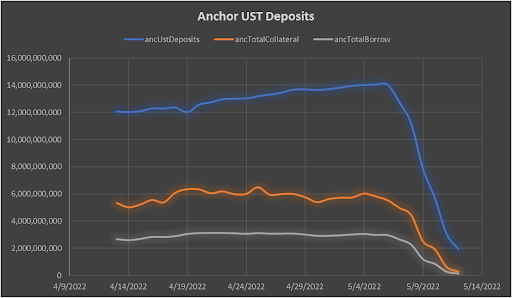

As of writing Anchor had collateral valued at ~261 million UST, or about 120 million USD at $0.45 USD to one UST. The yield reserve is 177 million UST, or approximately $53 million USD. Per data from Terra Analytics (fig3) the amount of UST deposited on Anchor fell almost 20% on May 7th alone, with 1.3 billion UST flowing out in a single day. Between May 7th and 8th something to the tune of $2.7 billion of UST was withdrawn from Anchor, with $220m and $330m going to just two accounts.

fig3. Anchor UST Deposits source

A highly correlated market & high inflation

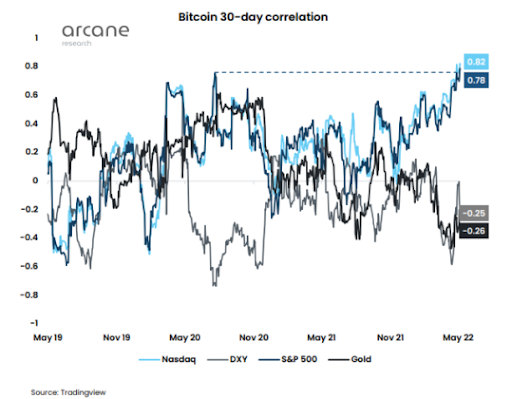

fig4. Bitcoin Correlation to NASDAQ and other indices source

The NASDAQ Composite Index is down 28% YTD and this has, in no small part, contributed to the decline of BTC (down 39% YTD) and ETH (down 44% YTD).

Also, Inflation is still here, it’s slowing down but not as quickly as expected, with an 8.3% increase in the CPI reported for April 2022 over the previous 12 months. This was higher than the predicted rate of 8.1%, so while inflation is slowing it isn't doing so as quickly as expected. This contributes to the ongoing sell off of risky assets. Recently, in response to inflation, the Federal Reserve issued the largest increase in interest rates since 2000 of 0.5%.

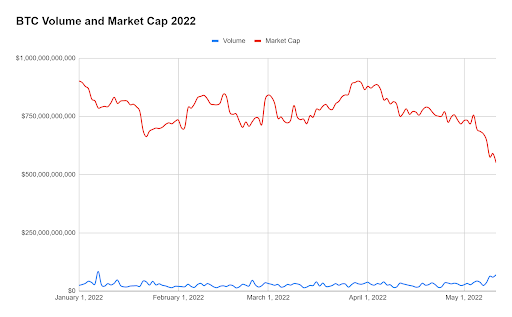

Similarly to the sell off in tech stocks, BTC has been seeing major trading volume, increasing in USD terms even as the price of BTC dropped dramatically (fig4).

fig5. BTC Volume and Market Cap in USD Source: Coinmarketcap data

Stablecoins without the Death Spirals

Many prominent stablecoins, such as Maker’s DAI, are overcollateralized. Meaning more assets are required to be locked up as collateral than can be taken out as loans. Maker started out with a 150% collateralization to loan ratio, meaning that $150 worth of collateral needed to be deposited in order to take a $100 loan in DAI. This mechanism provides the stablecoin issuer with significantly more protection than an algorithmic stablecoin similar to UST.

Tether’s CTO offered thoughts on algorithmic stable-coins in an interview on May 12th, articulating that such systems should require at least 300% backing in solid crypto assets. Tether also deviated from its peg on May 11th (down to $0.95), although it has mostly recovered ($0.9974).

UST has clearly illustrated the dangers of supporting a peg via a volatile, speculative asset. Paving the way for further experiments with appropriately proportioned reserves and more nuanced mechanisms for maintaining price stability.