- Product

- Documentation

- Blogs

- Contact us Exchange

EIP-1559 aims to make the Ethereum transaction fee market more predictable, by translating some of the volatility generated in virtue of demand for block space into volatility in blocksize. EIP-1559 aims to improve the Ethereum transaction fee market by introducing a ‘base fee’ that is burned and allowing dynamically adjusting block sizes up to twice the previous gas limit; these changes were committed as a part of the Londonhard fork in August of 2021, after a successful series of testnet deployments.

The transaction format changes included in EIP-1559 were backward compatible with the previous transaction format, although changes to the block size and headers, among others, required communication and cooperation between developers, node operators and the community broadly. Any node operator choosing not to update their client, to include the new protocol’s rules and details, would be left on the old version of the chain and not able to contribute to the new chain (the upgraded fork). Since the London upgrade included changes to the Ethereum protocol, including delaying the difficulty bomb, the upgrade involved the possibility of hard forking the network; in the case that some node operators did not upgrade to the new software, this would preclude their ability to validate blocks on the upgraded network (since transactions on the old protocol aren’t valid on the new version of the protocol), splitting the network into two-chains.

Prior to the London upgrade, almost all prominent blockchains used something resembling a first price auction, or a uniform price auction (where, working from the highest bidder down, the lowest available price is then paid by all qualifying participants). This prioritizes the inclusion of transactions in blocks; when there are more transactions in the mempool than are able to fit into the next block). All transactions include a bid price transaction fee and this exact fee is paid should the transaction be included in a block. In either case, there isn’t an obvious best strategy for choosing the optimal bid. In the case of a price auction, optimizing the choice of bid requires complex modeling and real-time blockchain usage data, in order to estimate the values of other bids. In the uniform price auction, the miner can include their own transactions with low fees:

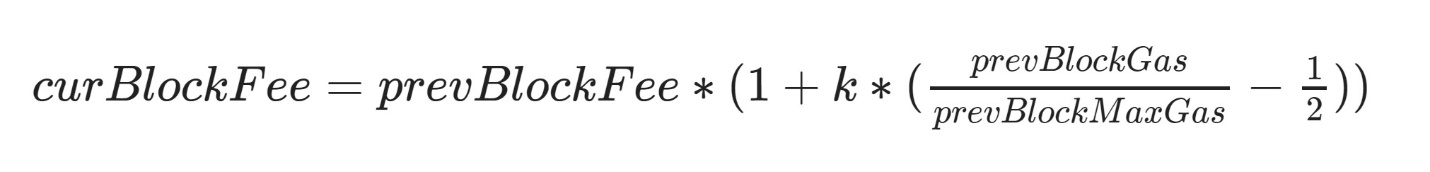

EIP-1559 aims to help simplify the fee market by including a minimum fee, which is updated on every block (targeting a long-term average of approximately the gas limit pre-London), and is a function of the proportion of gas used in the previous block (of the protocol determined maximum):

The success of the London hard fork bodes well for Ethereum’s transition to Proof of Stake; Buterin confirmed that the success of the London hard fork made him “more confident” in the success of the merge.

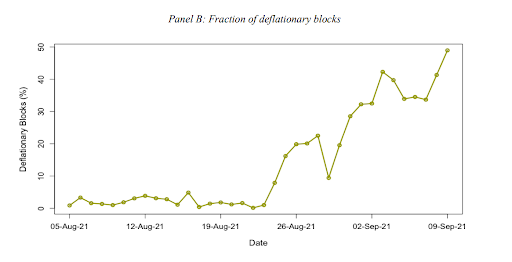

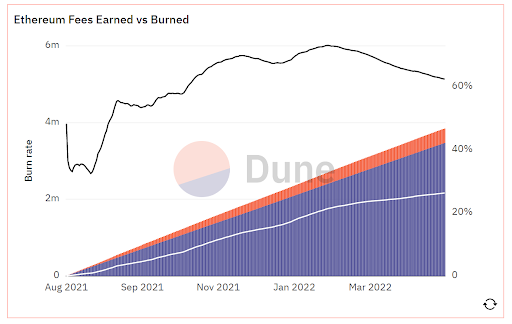

Since EIP-1559 went live in Q2 2022, $6.4 billion of ETH has been burned. The ~2million ETH burned are out of circulation forever, reducing ETHs supply. If the amount of ETH burned per block consistently exceeds the ETH issued per block then the network economics will become deflationary. It has been well documented that ETH has already had a number of deflationary blocks since EIP-1559’s implementation in August of 2021, such as in "Better than Bitcoin? Can cryptocurrencies beat inflation?" (Félez-Viñas, Foley, Karlsen, Svec; November, 2021). The proportion of deflationary blocks rose considerably following the London upgrade.

ETH has been burned at a growing rate while ETH’s emissions have maintained an approximately consistent rate. This suggests that ETH has a strong prospect of becoming a deflationary asset in virtue of EIP-1559 alone (before considering the decreasing ETH issuance expected with the upcoming merge). Even if ETH does’t become deflationary, EIP-1559 makes ETH more scarce by reducing the circulating supply when transaction fees are burned. All other things being equal, a decrease in supply will have an upwards price pressure on ETH. This is why some industry observers, such as the Australian academics cited above, consider ETH to be standing in competition with BTC as a store of value and hedge against inflation.

Throughout Ethereum’s history, approximately 5.4 million ETH have been issued annually, representing an inflation rate of approximately 2%. EIP-1559 is on pace to burn something of the order of 3 million ETH annually. Ultrasound.money project the merge to decrease issuance to 0.5 million ETH annually. If EIP-1559 presents a consistent trend then this would imply approximately net 2.5 million less ETH in circulation each year, or an inflation rate of -2.1%. While assumptions can be made regarding the amount of ETH staked and the number of participating validators, ETH’s exact inflation schedule post-merge remains to be seen.

The Ethereum network’s monetary policy is seeing major changes in virtue of EIP-1559 and the merge. The success of the London upgrade bodes well for continued improvements to Ethereum and the DeFi ecosystem’s ability to establish consensus on fundamental changes to the most prominent L1. In addition to making the Ethereum fee market more predictable EIP-1559 also changes Ethereum’s monetary policy by programmatically reducing circulating supply through transaction fee burns. Ethereum’s prospects as a store of value and hedge against inflation have only improved in recent months in virtue of EIP-1559 and the merge might well add to this yet.