- Product

- Documentation

- Blogs

- Contact us Exchange

TL:DR

Samuel Bankman-Fried(the man behind one of the largest crypto exchanges in the world, FTX, andone of the largest crypto-oriented hedge funds, Alameda Research) had to press the big red button at FTX - by which we mean the big red button that says “Turn Off the User’s Ability to Withdraw Funds”. On November 8th, one of the best known and well regarded exchanges in the industry suspended non-fiat withdrawals after ~$6 billion was withdrawn in ~72 hours. One of FTX’s early investors, Binance, may now be coming to the rescue, although the situation is evolving rapidly. There have been reasonable allegations made that this fiasco is inextricably linked to questionable “investment” decisions made by Alameda Research, leaving room to believe that we are still experiencing fallout from May’s Terra/LUNA collapse. Though FTX and Alameda’s leadership have both stepped down in recent months, the industry has been broadly caught off guard by the scale and scope of mismanagement of user funds.

Binance To Acquire FTX

Just when we all began to relax and feel more comfortable that some ludicrous series of egregious liberties taken with user funds isn’t going to crash the crypto markets, we are all humbled by one of the best respected exchanges suffering a liquidity crisis. How did we find ourselves at a point where Binance is tweeting “we did not master plan this”?

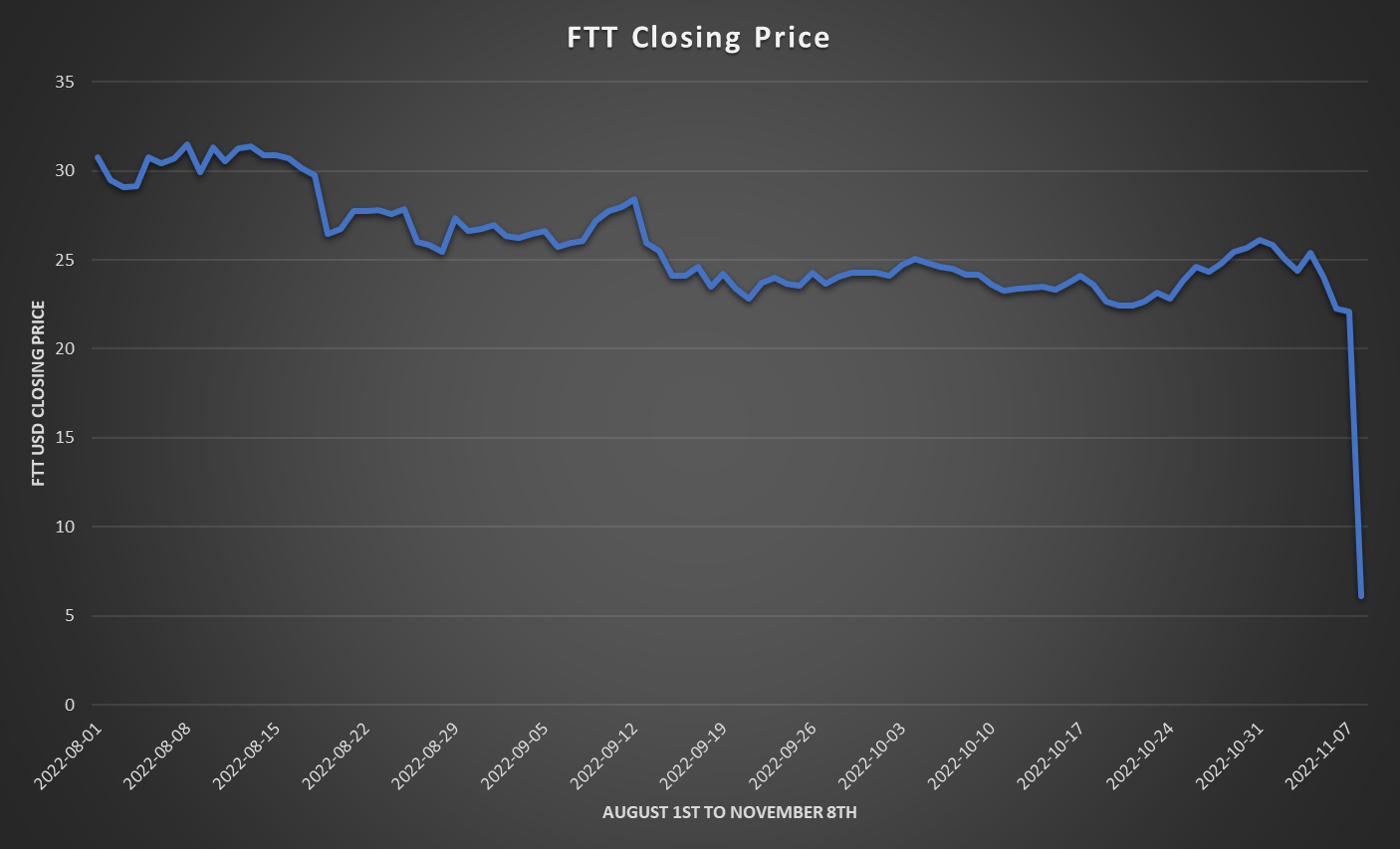

Having been an early investor in FTX, Binance received ~$2.1 billion USD (in BUSD and FTT) when they sold their equity in FTX. On November 6th, CZ announced that Binance would be liquidating their remaining FTT holdings. On 11/5 FTX’s FTT token traded at ~$25 USD and by 11/8 it was trading at ~$5. Binance’s CEO, Changpeng Zhao, has since announced (on the morning of November 9th) an intention to stop selling FTT while the details of their acquisition of FTX are fleshed out.

The background to Binance’s decision to start selling large quantities of FTT (somewhere in the region of $0.5 billion according to Bloomberg, though industry participants no doubt feared this could be closer to the $2.1 billion USD equivalent figure CZ mentioned) involves Alameda research appearing to be in financial distress, bickering about lobbying between major industry players and allegations of money laundering investigations.

It is also necessary to gain some intuition for SBF’s intricate and complicated web of interconnected projects. Alameda Research was the largest shareholder in Voyager digital, a company that filed for bankruptcy over the summer while owing ~100,000 creditors funds to the tune of billions of USD equivalent. Voyager had assured customers that their funds were FDIC insured, though this transpired to not be the case since this insurance was apparently contingent on funds being held by a specific (insured) bank, rather than (presumably) being rehypothecated in some way).

Source: Nomics

Sam Bankman-Fried (SBF), a well known young crypto billionaire, famous among other things for his affinity for the Effective Altruism movement, was listed among the major political donors in the United States; specifically SBF was the 6th largest donor to US political parties in the 2022 election cycle, ranking just after titans like George Soros and Kenneth Griffin, with his ~$40 million in donations, ~99.6% of which went to liberal causes. SBF’s offers to help bail out firms in turmoil earlier in 2022, combined with these major liberal oriented political donations, did a lot to cement SBF (and by extension FTX’s) standing in the industry as credible and trustworthy players. It is only with an eye to scrutinize SBF’s other initiatives, such as Alameda Research (a trading firm) that the above described moves appear potentially motivated by some ulterior factors.

Alameda

This whole sage does a lot to reiterate the importance of secure self-custody of funds. There have been reasonable allegations that Alameda works on the same flawed principles that destroyed Celsius, and in the process cost users billions of dollars. This (alleged) sort of rehypothecation of funds has caused tremendous problems this year, which we at Deepwaters havebeenpaying very close attention to. It appears as though Alameda might have been in similarly dire straits as 3AC and similar parties earlier in 2022.

Following a leak published by CoinDesk on November 11th allegedly describing Alameda's Q2 balance sheet, industry observers became confident that Alameda had most of their assets in tokens issued by SBF’s other projects. Comparisons to the Celsius style flywheel were not far behind, whereby a combination of user deposits, increases in token value and equity raises all coalesce to further inflate the value of a token. Such as any practice of using user funds to buy your own token and pump the price up. Things get even weirder when a large portion of the supposedly valuable token supply is locked up or otherwise not in circulation (similarly to Anchor protocol and UST, or OlympusDAO, or the longtail of disappointingly prevalent *#^!-coins). In what sense can Alameda count ~$5.8 billion USD worth of FTT tokens when this describes almost twice the circulating supply of the token?

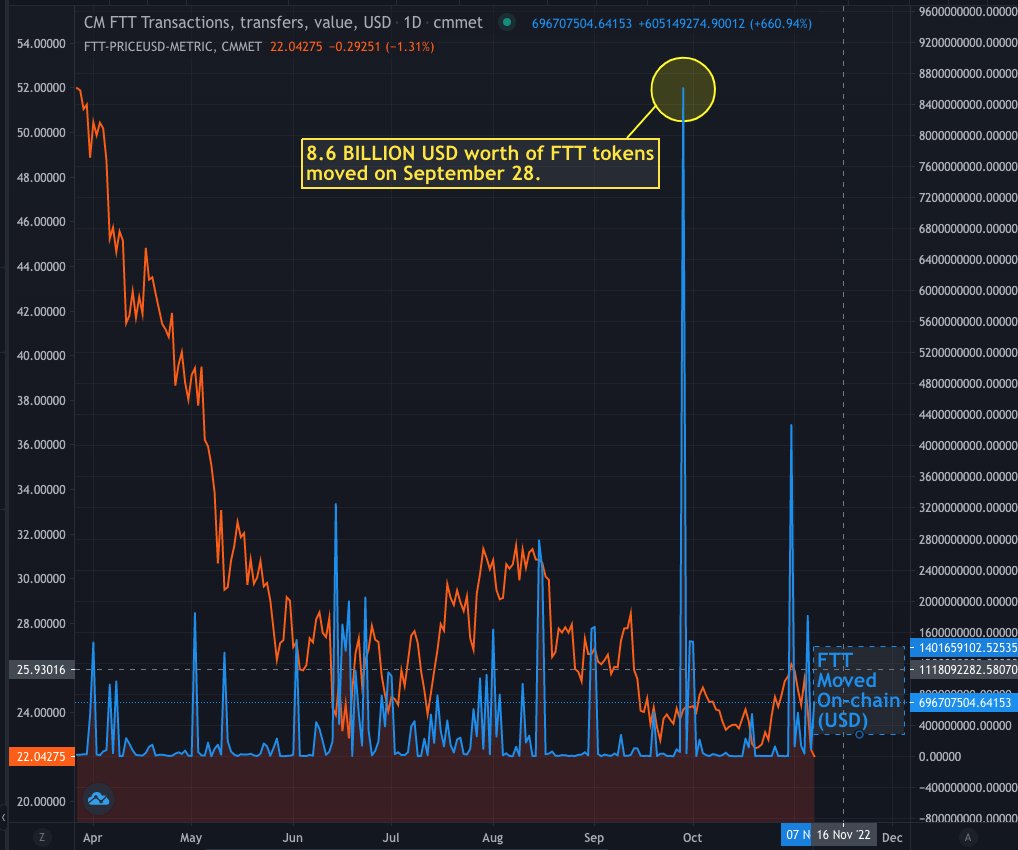

Though Alameda always had something 3AC and others did not, over 170 million FTT tokens guaranteed to vest in the near future. This future promise of tokens, which would only be valuable if the market still broadly had confidence in FTX and SBF personally, provided plenty of collateral alongside a pre-existing motivation for SBF to bail Alameda out. On September 28th ~$8.6 billion USD equivalent value of FTT suddenly came “on-chain”. Coinmetrics count this among the biggest ERC20 token moves to have ever occurred in a day, certainly among the largest Coin Metrics have recorded.

Credit to Coin Metrics & Lucas Nuzzi

The head of R&D at CoinMetrics reckons they’ve found evidence that FTX provided a “massive bailout” to Alameda in Q2. A little over a month ago, it appears that a smart contract on Ethereum (which was deployed in 2019) released ~170 million FTT tokens from the FTX ICO (representing a 1 yr active supply increase of ~124%). 173 million FTT tokens coming in at a market value of ~$4.2 billion USD seems to have traveled from the FTX ICO contract straight to Alameda Research. This in and of itself isn’t obviously ridiculous since Alameda participated in the FTX ICO, though it is still a major capital movement. These funds were then promptly sent from Alameda back to FTX.

Continuing to minimize the requirement for Trust

The insolvency of the 3rd largest crypto exchange in the world begs a rude awakening for the crypto industry on many fronts. Rather than waiting for similar initiatives and projects to produce better results, something we’ve written about before with regards to Einstein’s definition of insanity, it is time to focus on systematic improvements and iterative progress. Secure self-custody of funds prevents egregious rehypothecation of user assets and radical transparency ensures appropriate oversight by users and anyone interested. Another key lesson here is of course that “regulatory arbitrage” as it is sometimes called clearly has it’s limits. FTX US is FIDC insured and so for a series of reasons; it is unsurprising that FTX US did not restrict customer withdrawals in the same way as FTX international. Crypto companies that plan to do business in the U.S. have got to cooperate with regulators; those who don’t are doing the entire industry a disservice.